Introduction

Aaj ke time par, financial markets mein investment ke kai tareeke hain jo traders aur investors ke liye naye naye options laaye hain. In mein ek popular aur powerful tool hai “Options Trading.” Aur Options Trading ka ek zaroori hissa hai Option Chain. Lekin, Option Chain kya hai, aur kaise kaam karta hai? Ye samajhna har trader aur investor ke liye zaroori hai jo Options Trading mein interest rakhte hain. Is article mein hum Option Chain ke baare mein detail mein discuss karenge.

Table of Contents

Option Chain Ka Matlab Kya Hota Hai?

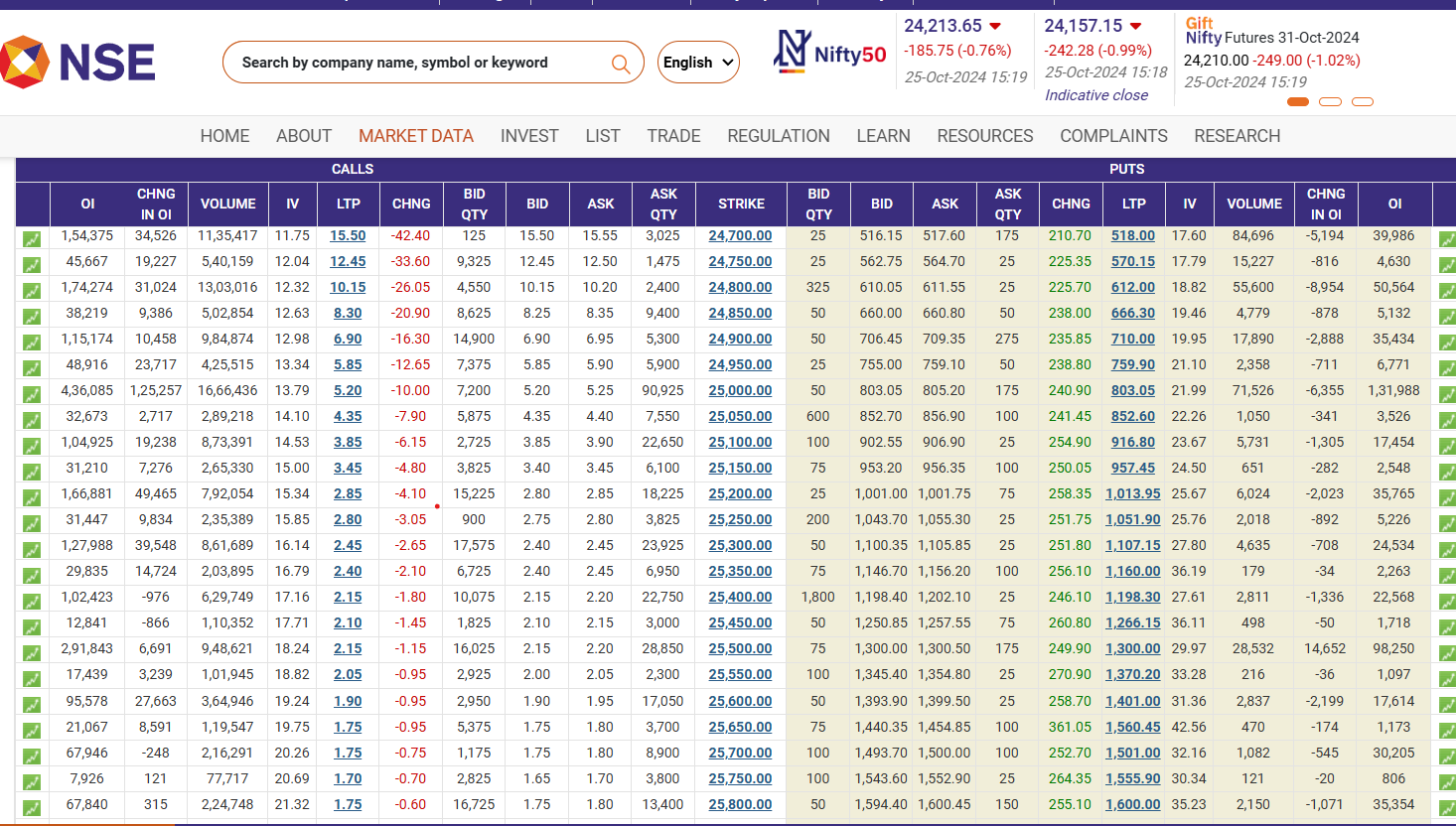

Option Chain ek aisa tool hai jo options contracts ke data ko ek systematic format mein present karta hai. Yani ki, yeh ek table jaisa hota hai jismein options contracts ke alag-alag strikes aur premiums dikhaye jaate hain. Option Chain ke through, traders asaani se dekh sakte hain ki kis strike price par Call aur Put options ke premiums, open interest, aur volume ka kya status hai. Yeh data traders aur investors ko decision-making mein madad karta hai.

Option Chain ke main components hote hain: Strike Price, Call Option, Put Option, Open Interest, aur Volume. Inko samajhna Option Chain ka deep understanding paida karne mein help karega.

Option Chain Ke Important Components

1. Strike Price

Strike Price woh price hota hai jismein options contract ko exercise kiya ja sakta hai. Option Chain mein alag-alag strike prices diye hote hain jinke basis par traders call ya put option ko buy ya sell karte hain. Strike Price decide karta hai ki aapka option in-the-money (ITM), out-of-the-money (OTM), ya at-the-money (ATM) hai ya nahi.

2. Call Option

Call Option aisa option contract hota hai jo buyer ko right deta hai kisi underlying asset ko ek specific price par buy karne ka, lekin obligation nahi deta. Option Chain mein Call options left side mein diye hote hain aur inka data Strike Prices ke saath list kiya jata hai. Call options ke premiums, volume, aur open interest ko dekh kar traders future ki price movement ke baare mein idea laga sakte hain.

3. Put Option

Put Option buyer ko right deta hai asset ko specific price par sell karne ka. Option Chain mein Put Options ko right side mein display kiya jaata hai. Put Options ka price aur open interest check karne se market mein downside ya bearish sentiment ka andaza lagaya ja sakta hai.

4. Open Interest (OI)

Open Interest woh metric hai jo market mein kitne active contracts (open contracts) hain, yeh dikhata hai. High open interest ka matlab hai ki us strike price par trading activity zyada hai. Option Chain mein OI ka data dekh kar traders ko samajh mein aata hai ki kis strike price par zyada interest aur activity hai, jo unke trading decisions mein bahut madadgar ho sakta hai.

5. Volume

Volume woh total number of options contracts hai jo ek din mein trade hue hain. Zyada volume ka matlab hai ki us particular strike price par zyada log interest le rahe hain. Yeh ek important indicator hai jisse traders ko samajhne mein madad milti hai ki kis taraf market ka trend ho sakta hai.

Option Chain Data Ko Kaise Analyze Karein?

Option Chain ko analyze karna Options Trading ka ek significant aspect hai. Kuch key factors jo Option Chain ko samajhne aur analyze karne mein madadgar hote hain, woh yeh hain:

1. Support aur Resistance Identify Karna

Option Chain mein Open Interest (OI) ke through support aur resistance levels identify kiye ja sakte hain. Jis strike price par zyada open interest hota hai, usse support ya resistance point ke roop mein dekha ja sakta hai. For example, agar kisi strike price par call options ka OI bahut zyada hai, toh woh ek resistance ho sakta hai, aur agar kisi strike price par put options ka OI zyada hai toh woh ek support level ho sakta hai.

2. Implied Volatility (IV) Ko Check Karna

Option Chain analysis mein Implied Volatility (IV) ek aur significant factor hai . Yeh predict karta hai ki future mein underlying asset mein kitna price movement ho sakta hai. High IV ka matlab zyada volatility aur risk hai, jabki low IV ka matlab comparatively stable prices hain. Traders IV ko check karke unke strategies ko accordingly adjust karte hain.

3. In-the-Money, At-the-Money, Aur Out-of-the-Money (ITM, ATM, OTM) Options

Option Chain mein options ko in-the-money (ITM), at-the-money (ATM), aur out-of-the-money (OTM) ke categories mein classify kiya jaata hai. Yeh classification options ki intrinsic value aur premium pe kaafi asar daalti hai. In options ko sahi tarah se samajhna traders ko sahi decision lene mein help karta hai.

4. Volume Analysis

Volume data ka analysis karne se pata chalta hai ki kis taraf market ka sentiment hai. Higher volume ka matlab hota hai zyada interest, jo ek strong indicator hota hai price movement ka. Low volume ka matlab hota hai ki us price par interest kam hai.

Option Chain Analysis Kaise Help Karta Hai Trading Mein?

Option Chain ek powerful tool hai jo options trading mein traders ke liye kai tarikon se help karta hai. Yeh kuch tareeke hain jinke through Option Chain ka sahi use trading ko asaan aur profitable bana sakta hai.

1. Trend Prediction

Option Chain ke data ko analyze karke traders ye predict kar sakte hain ki market kis taraf move kar sakta hai. High call OI aur low put OI ka matlab hota hai ki market bullish hai, aur high put OI aur low call OI ka matlab hota hai ki market bearish hai.

2. Risk Management

Option Chain ke data ko dekhte hue, traders apne risk ko manage kar sakte hain. For example, agar kisi strike price par IV bahut high hai toh woh trade high risk ke saath ho sakti hai, lekin agar IV low hai toh woh comparatively safe trade ho sakti hai.

Trading Risk Management: Ek Safal Trader Banne Ka Formula

3. Entry aur Exit Points ka Identification

Option Chain ke support aur resistance levels se traders asaani se apne entry aur exit points identify kar sakte hain. Jis level par zyada call OI ya put OI hota hai, woh strike prices entry aur exit ke liye use kiya ja sakta hai.

Option Chain Analysis Kaise Karein – Step-by-Step Guide

Ab hum samjhenge ki Option Chain kaise analyze karna chahiye ek practical example ke through. Yahan ek step-by-step approach diya gaya hai jo traders ko Option Chain ka analysis karne mein help karega.

Step 1: Underlying Asset Ko Select Karein

Sabse pehle, aapko us underlying asset ko select karna hai jismein aapko trade karna hai. Yeh asset koi stock, index, ya commodity ho sakta hai.

Step 2: Expiry Date Ko Select Karein

Har option contract ki ek expiry date hoti hai. Option Chain analysis mein us expiry date ko select karna zaroori hai jismein aap trade plan kar rahe hain. Generally, monthly ya weekly expiries commonly trade hoti hain.

Step 3: Strike Prices Ko Observe Karein

Expiry select karne ke baad aapko available strike prices ka analysis karna hai. Option Chain mein har strike price ke saamne call aur put options ke premiums, OI, aur volume dikhaye gaye hote hain. Unhe observe kar ke trend ka idea lagaya ja sakta hai.

Step 4: Open Interest aur Volume Ka Analysis Karein

Option Chain ka Open Interest aur Volume data dekh kar aapko kis taraf ka trend hai, woh samajhna chahiye. High OI aur volume wale strike prices par zyada trading activity hoti hai jo ek strong indicator hota hai.

Step 5: Implied Volatility Ko Check Karein

IV ka analysis karke aapko risk aur expected volatility ka andaza lagta hai. High IV aur low IV ko dekh kar traders apni risk management strategy bana sakte hain.

Conclusion

Option Chain ek advanced tool hai jo options traders ko market ke mood aur sentiment ko samajhne mein madad karta hai. Yeh traders ko detailed insights provide karta hai jo decision-making mein beneficial hote hain. Chaahe aap beginner ho ya experienced trader, Option Chain ka analysis aapke trading journey mein ek bahut hi powerful weapon ban sakta hai.

Option Chain ko samajhne ke baad, aap options trading mein confident aur effectively participate kar sakte hain. Toh agle baar jab aap Options mein trade karne ka sochen, toh Option Chain ko zaroor use karein aur sahi decision le kar apne trading goals ko achieve kare